At the end of most previous recessions, hiring has increased among state and local governments, helping the broader economy to recover.

That's not happening this time around.

Layoffs have started to taper off, and tax receipts are starting to improve. But states are still a long way from bringing their workforces back up to pre-recession levels. And cities and counties remain in greater fiscal peril.

The employment report released last Friday showed that state governments had hired 2,000 more people in March, but those gains were more than offset by 3,000 jobs lost at the local level.

Altogether, state and local governments are still down nearly 700,000 positions, compared with April 2009.

So, while the public sector is no longer creating a drag on the overall employment picture, as it was just a few months ago, it's not likely to turn around and help things out much for the foreseeable future.

"Communities are glad they've hit bottom, but they're not expecting that the bottom is a trampoline and they're going to bounce right back up," says Geoff Beckwith, executive director of the Massachusetts Municipal Association.

Caution Remains The Watchword

After years of big drops, tax collections have been improving, particularly for states. From the middle of 2009 to the third quarter of last year, total tax receipts increased nearly 11 percent, thanks mainly to healthy growth in income and sales taxes, according to a Government Accountability Office study released last week.

Communities are glad they've hit bottom, but they're not expecting that the bottom is a trampoline and they're going to bounce right back up.

But states still haven't caught up to where they were before the recession. Their total revenues this year are expected to be $659 billion, according to the National Association of State Budget Officers.

That's still well under where they were back in 2008, when they took in $680 billion. Since that time, populations have grown and costs have risen in areas such as education, health care and unemployment insurance.

Since President Obama took office, the federal government has repeatedly sent billions out to states and localities to stave off job losses, particularly among schoolteachers, but the funds haven't been enough. California alone has lost 32,000 teaching positions since the 2008-'09 school year.

"State and local governments are just going to be unable to carry out the programs that they did before, because there aren't the revenues," says Sujit CanagaRetna, senior fiscal analyst for the Council of State Governments.

Need Not Apply

Some states are still struggling. The Washington state Legislature, for instance, is currently meeting in special session in hopes of finding $1 billion in savings between now and June 30.

"We're definitely still in a job-shedding mode," says Ralph Thomas, spokesman for the state's Office of Financial Management.

That's not the case in most states. Nearly every state, during the recession's trough, either laid off workers or imposed furloughs, hiring and salary freezes — or some combination of all those things.

In most states now, workers who leave are likely to be replaced, which wasn't the case a couple of years ago. But few state agencies are in anything like an expansion mode.

Even where budgets have become more robust, there's still concern about the fragility of the economic recovery and worries about rising education and Medicaid costs.

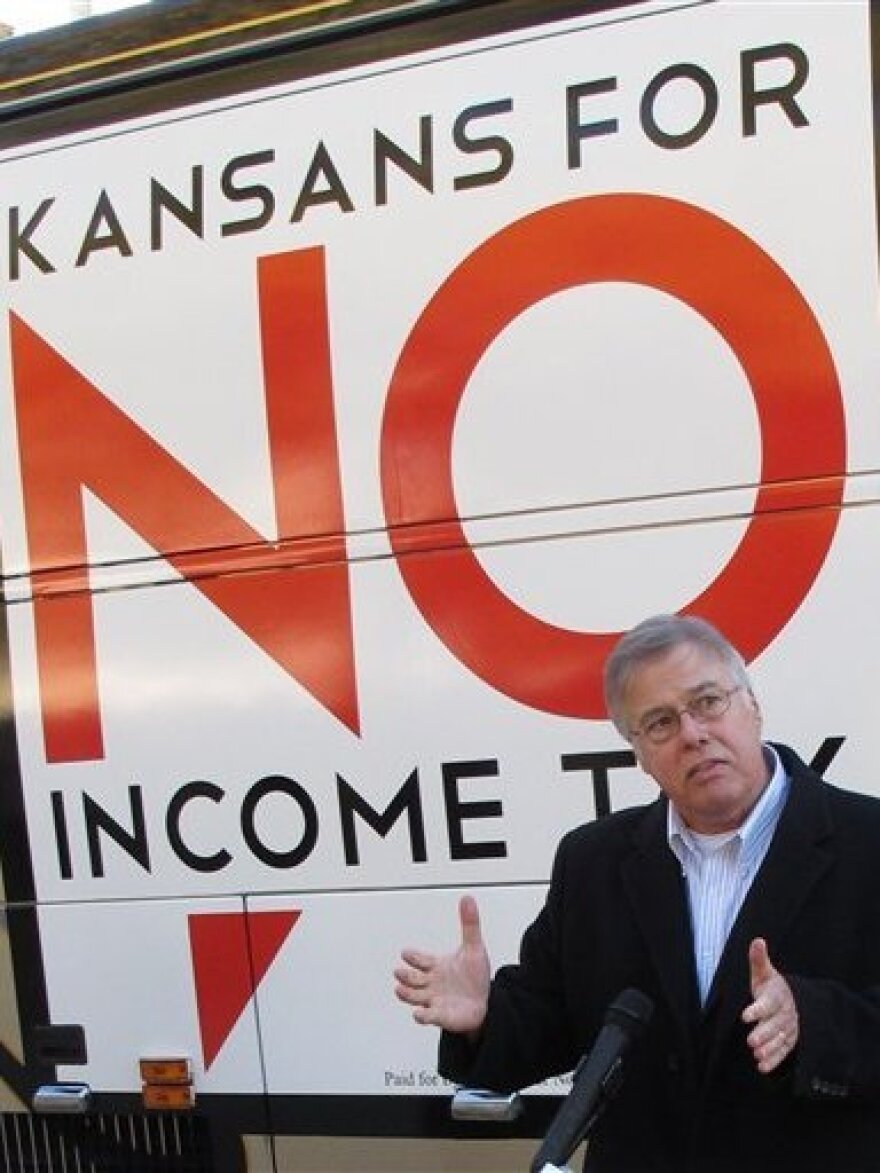

And, particularly in states governed by Republicans, increases in revenue may be devoted not to hiring but to tax relief. Tax cuts are viewed by many GOP leaders as a better way to stimulate economic growth and job creation than expanding government programs.

In Oklahoma and Kansas, legislators are seriously considering abolishing income taxes altogether.

"There's more of a feeling than there was even a few years ago, if the money is there, legislators don't want to use it to return or add jobs to the state payroll," says Matt DeCample, spokesman for Arkansas Gov. Mike Beebe, a Democrat. "You've still got a pretty strong sentiment where, if there is additional funding available, that's not going to be the first place legislators are going to want to use it."

Fear Of Fixed Costs

By this point following the recession of the early 1980s, government hiring had already started to pick up, according to Tracy Gordon, a fellow in economic studies at the Brookings Institution.

State budget officials are highly conscious of the fact that new employees bring with them considerable additional costs, in the forms of pensions and health benefits.

"For every employee who's hired, there's a great deal of awareness that along with that comes a very expensive health insurance bill," says Beckwith, the Massachusetts municipal league official.

Cities and counties remain in more dire straits than states — in part because states have taken their fiscal troubles out on them by cutting various local funding programs.

Local governments also rely heavily on property taxes, which remain flat because of the weak housing market. That means public sector employment is likely to remain sluggish for quite some time, because the bulk of the jobs are actually at the local level. (Much of what states spend their money on is not personnel costs, but writing checks to service providers such as school districts and hospitals.)

With 14.1 million employees, local government payrolls are now at their lowest level since February 2006.

"State government employment has increased for the past three months, but local government employment is still declining slightly," says Ronald Fisher, a public finance expert at Michigan State University. "Of course, local governments employ three times as many people as state governments do."

Copyright 2020 NPR. To see more, visit https://www.npr.org.