Spritzing perfume is how Judy Johnson realized her eyesight had gone bad.

At one point, diabetes had worsened her vision so much that the 69-year-old Lansing, Kan., resident had to squirt out a puff of her favorite scent just to find the opening in the mister.

“I looked at it this morning,” Johnson said Wednesday, “and I could see the hole.”

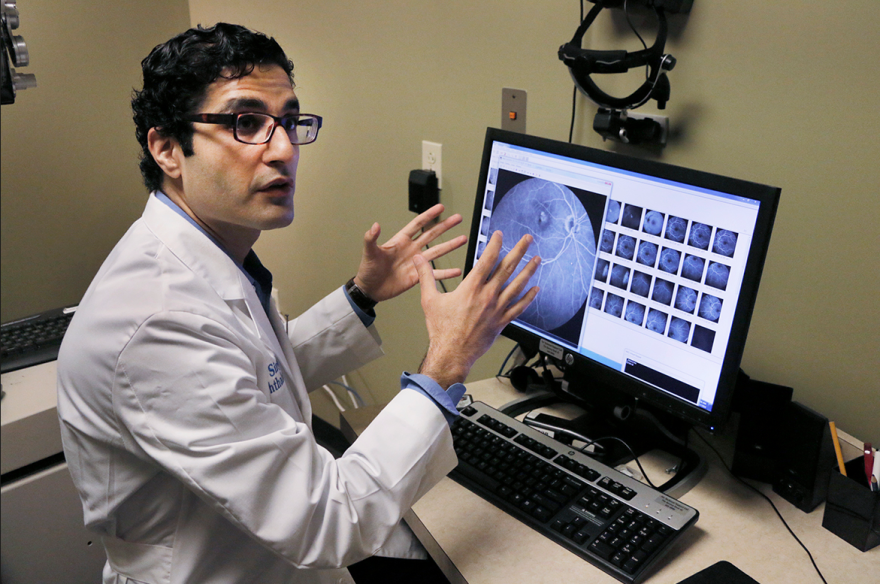

Johnson was at the University of Kansas Eye Clinic office in Prairie Village for a follow-up appointment with retina specialist Dr. Ajay Singh. He had injected her left eye the day before with a drug called Lucentis, one of 60 shots she has received in both eyes to combat macular edema, a disease in which fluid leaks from damaged blood vessels and blurs vision.

Patients generally receive one injection a month in each affected eye, though physicians can extend the time between treatments when the condition improves. Patients with macular edema, and other similar diseases, must continue to receive the shots to maintain their vision.

To Singh, drugs like Lucentis represent the biggest breakthrough in ophthalmology since the advent of safe cataract surgery three or four decades ago.

“Ten years ago these patients just went blind,” he said. “There was nothing.”

But the therapeutic benefits of the drugs have, to a certain extent, been clouded by a long-running debate about the cost effectiveness of Lucentis in comparison with a closely related drug called Avastin. Genentech, a biotechnology company based in San Francisco, manufactures both.

At stake are potential savings to Medicare, the federal health insurance program that covers some 54 million Americans age 65 and over as well as people with permanent disabilities. Projections call for outlays from the program to increase by about two-thirds in the next decade to $858 billion.

A debate that had been confined mostly to the medical community burst into the headlines this spring – and continues to reverberate – after the federal Centers for Medicare & Medicaid Services (CMS) released physician payment data for Medicare.

Many eye doctors argue that the data – released in response to an open-records battle going back to 1979 – left the impression that ophthalmologists were getting rich off of Medicare. In fact, they said, a significant percentage of the reimbursements passes through their practices as payments to the drug companies.

After expenses, Singh said, physicians probably only keep about 4 percent of the total Medicare payment. “CMS did not release that data,” he said, “and they should have.”

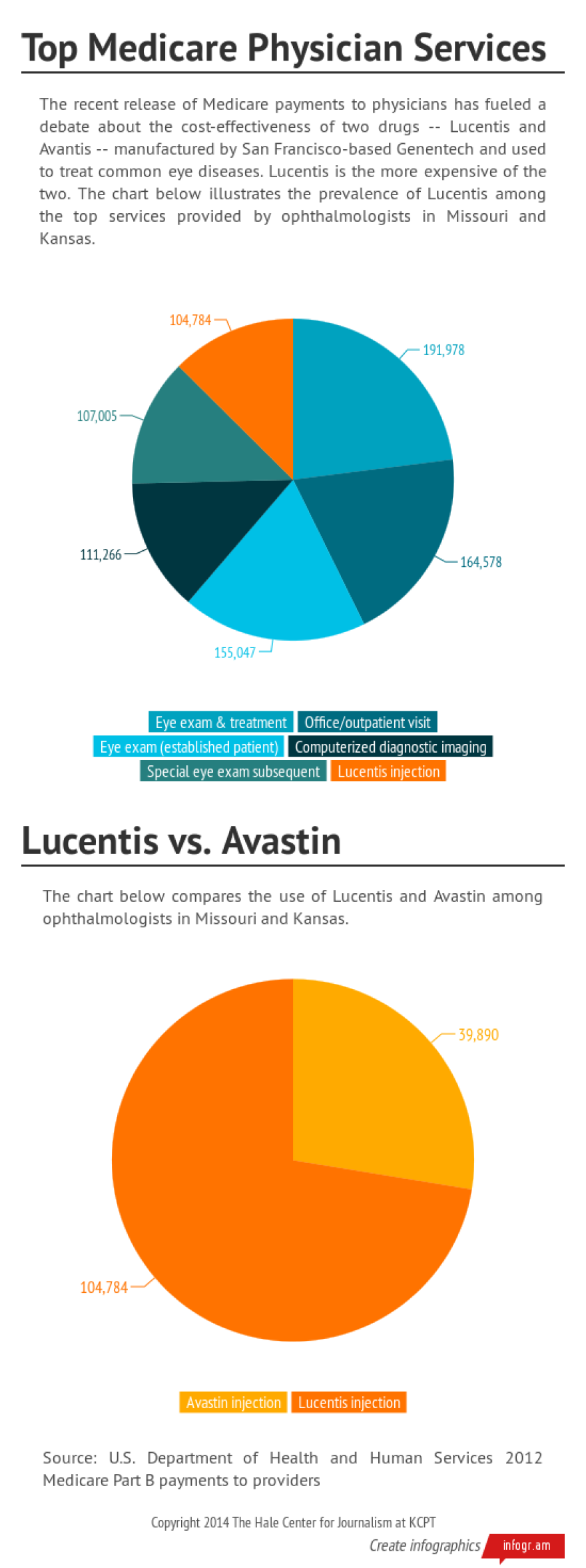

As is the case nationally, local ophthalmologists collected some of the highest reimbursements among physicians in Missouri and Kansas.

Data divide

The data released by CMS contains information on 880,645 Medicare providers nationally (including labs and ambulance services) for calendar year 2012. Payments to these providers totaled $77.4 billion.

For Missouri and Kansas, the data includes more than 27,000 providers with reimbursements totaling $2.2 billion.

In a letter to the American Medical Association in advance of the release, CMS Principal Deputy Administrator Jonathan Blum explained that agency officials believed release of the data served the public interest.

“The Department,” he wrote, “concluded that the data to be released would assist the public's understanding of Medicare fraud, waste, and abuse, as well as shed light on payments to physicians for services furnished to Medicare beneficiaries, which are governed by statutory requirements that CMS must follow.”

Blum specifically mentioned that, using similar data, the Wall Street Journal had uncovered Medicare abuses among physicians in its 2010 series, “Secrets of the System.”

Many of the top billers in Missouri and Kansas were ophthalmologists, including several working with Retina Associates, which collectively received $18.2 million in Medicare reimbursements in 2012. That practice has offices throughout the metropolitan area in addition to locations in Topeka, Sedalia and other communities in Missouri and Kansas.

According to the data, the use of Lucentis among the two Retina Associates physicians with the highest Medicare reimbursements dwarfed that of Avastin. In the case of one of the physicians, the average Medicare reimbursement for Lucentis was about four times more than the average for Avastin.

In an email, Retina Associates CEO Sean D. Goodale said the practice did not have anything to add to official responses about the data issued by professional organizations, including the American Society of Cataract and Refractive Surgery (ASCRS) and the American Academy of Ophthalmology.

ASCRS noted that cataract surgery is the number one Medicare-reimbursed surgical procedure and Medicare beneficiaries typically comprise about 65 percent of an ophthalmologist’s patient base.

The top individual Medicare payment recipient in the national database was a West Palm Beach, Fla., ophthalmologist, Salomon Melgen who took in about $20.8 million in Medicare payments in 2012, according to the data. Melgen is reportedly under investigation for Medicare fraud related to the use of Lucentis.

CMS’s user manual for the data includes nearly two pages listing its limitations, including that it does not say anything about the quality of care provided and is not risk-adjusted to account for the differences in severity of patient populations among providers.

As for drug costs, the manual says that, in general, “when a provider administers drugs to a patient, the provider purchases the drug and Medicare pays the provider 106% of the average sales price for the drug.”

Despite all the cautions and qualifications from CMS, ophthalmologists complain the data has left the impression they are fleecing the government.

Historical context

The story of the two Genentech drugs dates to 2004, when the U.S. Food and Drug Administration (FDA) first approved Avastin for treatment for metastatic colorectal cancer.

In early use, physicians noticed that Avastin improved age-related macular degeneration (AMD) in cancer patients also suffering from that disease, said Dr. Manju Subramanian, a vitreoretinal surgeon and associate professor of ophthalmology at Boston University School of Medicine and Boston Medical Center. Her research has found Avastin and Lucentis worked equally well in treating macular degeneration.

AMD is a common eye condition and a leading cause of vision loss among people age 50 and older, according to the National Eye Institute, which is part of the National Institutes of Health (NIH). It causes damage to the macula, a small spot near the center of the retina and the part of the eye needed for sharp, central vision, which lets humans see objects that are straight ahead.

At the same time physicians were discovering the ocular benefits of Avastin, Genentech was also working on a similar drug aimed specifically at treating macular degeneration. However, a retina specialist at the University of Miami, Dr. Philip Rosenfeld, hoped to expedite treatment for his patients by tailoring Avastin into smaller doses for treatment of AMD.

Rosenfeld found that Avastin worked very well in its so-called off-label form —where providers use a drug for a purpose different from the one approved by the FDA.

“So people all over the world were using Avastin,” Subramanian said, “because Avastin only cost 50 bucks an injection.”

The FDA approved Lucentis for treating AMD in 2006, and it sells for about $2,000 a dose.

Retina specialists now face a choice in treating their patients: Do they use a less-expensive option in its off-label form or do they use a more costly alternative approved specifically for eye disease?

Two years ago, in a study supported by the NIH, researchers found that Lucentis and Avastin both produced “dramatic and lasting improvement in vision,” in the words of the study’s principal investigator.

The study, however, found that about 40 percent of the Avastin patients experienced “serious adverse events" versus 32 percent for the Lucentis patients. In the past, authorities have tied outbreaks of severe eye infections among Avastin patients to contamination of the product by the specialized pharmacies that prepare it for ophthalmologic use.

In September 2011, shortly after the release of preliminary results from the NIH study, internal auditors at the U.S. Department of Health and Human Services determined that Medicare and its beneficiaries would have saved about $1.4 billion in the two previous years had specialists treated all so-called wet AMD patients with Avastin.

Doctors also have a relatively new alternative called Eylea, which has been on the market for nearly three years and is approved specifically for conditions like macular degeneration.

Physicians said Lucentis and Eylea are comparably priced.

The common practice now, physicians said, is to rely on all three drugs – along with other therapies such as laser treatment – depending upon which compound produces the best results for the patient.

“The algorithm I follow,” Subramanian said, “is I try Avastin first. If they don’t do well on Avastin, then I go for Eylea, and then if not, I will go for Lucentis.”

Throughout the debate about the efficacy of the drugs, critics have criticized Genentech as having a profit motive in pushing the more expensive Lucentis over Avastin.

In an e-mail, a spokeswoman for the company noted the safety concerns about the off-label use of Avastin by ophthalmologists and said Lucentis had been subject to rigorous review by the FDA.

“Rather than invest substantial resources and years of clinical development and research necessary to explore the safety and efficacy of Avastin for use in the eye -— ultimately driving up the price,” she wrote, “we believe it is in the best interest of patients to focus our efforts in ophthalmology (on) discovering and developing new potential medicines for other serious conditions of the eye.”

Correction: A previous version of this story incorrectly described the development chronology for Avastin and Lucentis.