February’s disappointing revenue numbers have Kansas lawmakers once again scrambling to balance the state budget.

The spending blueprints for the remainder of the current fiscal year and fiscal year 2017, which begins July 1, were balanced on paper when lawmakers left for a brief mid-session break, thanks to a series of one-time revenue transfers and some spending reductions.

But both were undone when the Kansas Department of Revenue reported last week that February tax receipts had come in $54 million short of projections.

Minutes after the February numbers were made public, Gov. Sam Brownback issued a statement countering assertions from Democrats and moderate Republicans that the income tax cuts he championed in 2012 were to blame for the state’s going budget problems.

“This is an economic problem, not a tax policy problem,” Brownback said.

Ruling out a tax increase, Brownback said he intended to rebalance the budget by “managing spending” and ordered an immediate $17 million cut in state university budgets.

Fear of repeat of last year

Like Brownback, GOP legislative leaders appear determined to avoid a tax increase. Last year, they were forced to put their members on the line to pass the largest tax increase in state history — a combination of sales and tobacco tax increases — to close a $400 million budget gap.

But this is an election year.

“There is certainly going to be no movement of tax increases until we start to see March and April figures, and I don’t think we’ll see any movement then,” said Marvin Kleeb, the Overland Park Republican who chairs the House Taxation Committee. “The governor has made it clear that he doesn’t want to look at any tax increases, and I think the Legislature isn’t going in that direction either.”

Despite veto threats from Brownback, several legislators, including some conservative Republicans, want to repeal or adjust the 2012 income tax cuts.

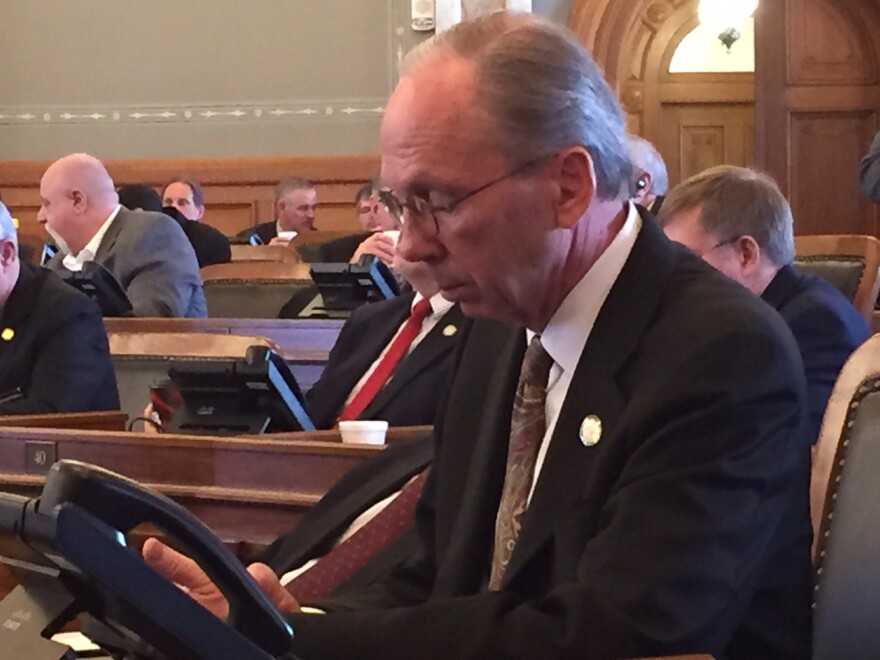

Rep. Mark Hutton, a Wichita Republican, failed last year in an attempt to repeal a provision that exempted more than 300,000 Kansas business owners from state income taxes. But he’s back this year with a new bill. He said while the exemption may have motivated some owners to open their businesses in Kansas, there’s little evidence that it has achieved Brownback’s goal of creating new jobs.

“So far the state has spent well over $700 million on what essentially is an economic incentive program for LLCs (limited liability companies) and sole proprietorships and partnerships,” Hutton said. “I believe that has not yielded a very good return.”

Hutton hopes that a change in this year’s bill will garner more support from Democrats and moderate Republicans. Instead of using the revenue generated by restoring the business tax to plug holes in the budget, the bill would use the money to slash the statewide sales tax on food from 6.5 percent to 2.6 percent.

The House Taxation Committee is expected to have hearings on Hutton’s bill next week. And he said he won’t be surprised if there are attempts to redirect the money.

“Whether or not this ends up actually reducing the sales tax or not on food, I don’t know,” he said. “I mean it could get hijacked for (the) state general fund.”

State fire sale

With a tax increasing seemingly off the table, lawmakers are looking for cash wherever they can find it.

Proposals to implement various recommendations from an efficiency study done by a national consulting firm surfaced last week in several House and Senate committees. The study, done prior to the session, contained dozens of recommendations that the consultants said could save approximately $2 billion over five years.

Legislators also are considering a spate of bills that would generate additional cash without raising taxes.

One of the proposals would require cities to share more of the traffic fines they collect with the state. Another would sweep approximately $250,000 into the state general fund by abolishing the Kansas Electric Transmission Authority, an agency established about 10 years ago to help coordinate the construction of transmission lines from wind farms. Still another would facilitate the sale of the Kansas Bioscience Authority and its investment holdings for an anticipated $25 million.

Sen. Laura Kelly of Topeka, the top Democrat on the Senate Ways and Means Committee, said it’s like the state is conducting a fire sale.

“There is real desperation to get through the session and get through the election without having to raise taxes,” Kelly said, referring to the strategy of the Legislature’s Republican majority. “It’s absolutely sad because these are the kinds of things that can’t be undone. Once we sell the bioscience authority, it’s gone. It’s somebody else’s baby.”

Jim McLean is executive editor of KHI News Service in Topeka, a partner in the Heartland Health Monitor team.