For more stories like this one, subscribe to Real Humans on Apple Podcasts or Spotify.

When I first started renting an apartment in Kansas City, in 1999, no one in my friend group — mostly artists working service industry jobs — paid more than $425 a month. And most of us lived alone.

Not too long ago, cheap rent like this was Kansas City's main attraction. Seattle had coffee and music. California had good weather and beaches. New York had the most exciting jobs and tons of cool stuff to do (if you could find the time and money to actually enjoy it).

This city, meanwhile, had affordable apartments. But what people now pay to share spaces with roommates — it hurts my brain (and not because I don't understand the kind of market forces that push up rent).

What doesn't quite compute is when, exactly, this happened. I remember rent being affordable. Then suddenly, it wasn't. But I can't quite pinpoint the shift.

I worry, too, how the average renter here in town makes up the difference — and how life in Kansas City changes if they can't.

The other week, I got on Twitter and invited folks to play a game with me: "Tweet me what you paid for your first rental in the metro."

Let's try it another way. Tweet me what you paid for your 1st apartment/rental in the metro, where it was, # of rooms and bathrooms. I will correct for inflation and tell you what that would be in 2021 as well as what similar rentals in the same neighborhood go for now. https://t.co/S8mJvX86x9

— Gina Kaufmann (@GinaKCUR) September 30, 2021

Almost 100 people shared their stories, and not surprisingly, they revealed a pretty clear pattern: Rent has gone way up in City Market, Columbus Park, the Crossroads. But it's climbed even more dramatically across various Midtown neighborhoods.

A two-bedroom in Westport went for $850 in 2013 (more like $950, correcting for inflation). You'd be hard-pressed to find a similar apartment now for under $1,300.

A two-bedroom house in East Brookside rented for $350 in the late 1990s (more like $600 today). Renting a similar home now costs closer to $1,500 a month.

A one-bedroom in Volker, right off West 39th Street, went for $500 in 2011, just one decade ago. Even with inflation, that's just $620 today. An available unit in the exact same building is currently listed for $950.

Across most of Midtown, rental rates appeared to have doubled in just the last decade. And just about every unit I saw cost more than $800. Where could you go, I wondered, for under $800 a month?

I expanded my search, scoured metro listings, and realized that a place in that budget is nearly impossible to find in Kansas City. We're not just talking about a minimum square footage or specific neighborhood. We're talking rentals of any size, in any neighborhood.

"I think a lot of people's knee-jerk reaction when they hear about increasing rents in the city, it's like, 'Oh, it's downtown, it's Crossroads, right? Like it's really expensive to live there,'" says Erin Royals at the University of Missouri-Kansas City Center for Neighborhoods. "I'm like, 'That's not the story.' I know where people have been experiencing huge increases in their cost of living. And it's not downtown. It's not the Crossroads. It's on the east side."

Royals has a master's in urban planning, and she's in the process of getting her Ph.D. in geography. She says what's happening in Kansas City can be explained by a gap between what an area currently is worth, and what it could be worth.

"Capital is always going to go where it can make the most profit," Royals says. "The further east you go, that gap gets bigger and bigger."

Data from market analysts at Cushman and Wakefield corroborates what she's saying: Not only is rent going up, but the people seeing the biggest rent hikes are also the ones who can least afford it.

Rent in Kansas City went up 6% overall from the second quarter of 2020 to the second quarter of 2021.

According to Matthew Nevinger, who specializes in the Kansas City market at Cushman and Wakefield, that's basically unheard of. "Normal annual rent growth would run 2-3%," Nevinger says.

If you zoom in on eastern Kansas City, the data is even bleaker. Over the same time period, rent increased by 13.1% in eastern Kansas City. Meanwhile, Nevinger calculates only 4.8% wage growth for the same part of the metro over the same time period, using U.S. Bureau of Labor Statistics data.

"So 12 months earlier, your rent in east Jackson County, in Independence and east Kansas City, was $791 per unit, which was the lowest in the Metro area," Nevinger says. "And now it's all the way up to $895."

Those increases were highest for low- to mid-range units. That is to say, places renting to working class people.

Young people often compensate by divvying up rent among roommates. But that strategy doesn't work for everyone.

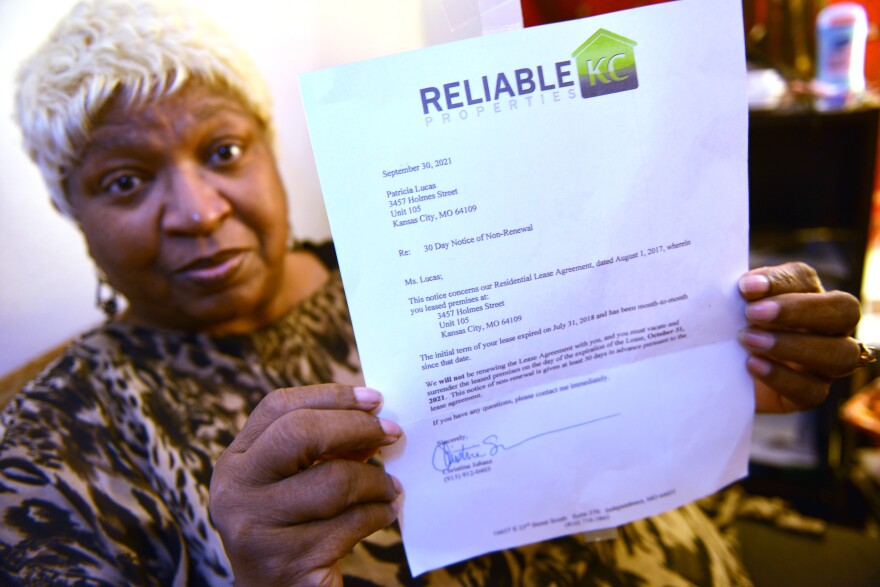

Take, for example, Pat Lucas. At 67 years old, she's retired from a long career working various security jobs, notably at the Federal Reserve Bank of Kansas City. Understandably, she wants her own place.

Lucas has lived in the same apartment building on Armour Boulevard in Midtown for 17 years. But she and a number of other residents just got notice that they have to move out — and soon. New ownership plans to rehab the property, and once it's been renovated, Lucas says her apartment's rent will jump from $650 a month to more than $1,000.

She's now searching for a new apartment, and says she would have a hard time affording rent over $700.

"It would be pushing my limit on stuff, because you know, there are times when you have to — how I want to put it — sometimes with my medications, if it says take two a day, I take it once a day," Lucas admits. "That's just to save money."

It's not just money at stake. Lucas — who walks with a cane — watches her small granddaughter during the day part of the week. Knowing her neighbors made that duty feel easy and safe. Starting over somewhere else, she'll have to rebuild the sense of comfort that comes from familiarity and belonging.

Which makes me think, again, of my question: How do renters make up the difference, and how does Kansas City change if they can't?

According to 30-year-old Wilson Vance, who grew up in a small Midtown apartment with her mom, Kansas City soon won't be recognizable if this keeps up.

Vance is an organizer for the housing rights group KC Tenants. She calls herself the "quintessential townie" — working barista jobs in Midtown from the time she moved out on her own at 16.

In her 20s, Vance thought maybe she'd like to try living in another city. But when she visited those bigger cities, what she saw were prohibitively expensive apartment buildings that all looked identical to one another.

"I would come back here and I'd be like, 'Well damn, at least it's not like that in Kansas City.' And then I started seeing it happen in my own city, in my own neighborhood," Vance says. "Two years later, I was priced out of my home of 10 years."

Eventually, her mom got priced out too.

“We are basically sending a message," Vance says, "that folks like my mom and me don’t matter.”

Now, every time Vance sees construction in her new neighborhood, it scares her, because she sees it as a sign that she soon won’t be able to afford the new home she’s made. She doesn’t know how long she, and other renters like her, can stay one step ahead of Kansas City’s “revitalization.”

What she wants is simple — and crushing.

"I want to die here," she says. "I want to grow old in Kansas City."

This story is part of a series on housing issues in the Kansas City region produced by the KC Media Collective, an initiative designed to support and enhance local journalism. Members of the KC Media Collective include KCUR 89.3, American Public Square, Kansas City PBS/Flatland, Missouri Business Alert, Startland News and The Kansas City Beacon.