COVID nudged El Centro into the housing business.

The pandemic revealed problems that the Kansas City, Kansas-based social service agency hadn’t realized were affecting immigrant families in Wyandotte County.

Staff became deeply attuned to housing issues, which worsened as Latinos suffered disproportionate rates of death and serious illness due to the virus.

The stories were eye-opening.

Renters of houses were being told what their share of a utility bill would be without proof of the actual charges. Bills weren’t in the renter’s name, but in the name of a landlord who often lived out of town.

People didn’t have formal leases. Instead, they relied on verbal agreements.

Some believed they had purchased a piece of their American Dream, paying for a home outright. But they lost the property later, due to the lack of a clear title and being unfamiliar with the legal need to record the purchase.

“They often didn’t recognize that they were suffering abuses from the owners,” said Elizabeth Reynoso, vice president of programs at El Centro.

Many immigrant families assumed that such struggles were simply the way business was done in the United States. And some families were hampered because they weren’t fluent in English.

El Centro developed Bienvenido a Mi Casa as a solution.

It’s a 12-month program, a deep dive into financial literacy, mortgages, inspections, insurance — everything a person would need to become a successful homeowner in Wyandotte County.

The sessions are in Spanish, leveraging existing programs in the county.

Some of those programs benefit from $1.3 million that the Health Forward Foundation invested in June. (The Health Forward Foundation also is a funder of The Beacon.)

The funding for 13 organizations focused on increasing access to healthy, affordable housing and homeownership in the Kansas City region.

Build WyCo, formerly Community Housing of Wyandotte County, received $70,000 with a goal of building, renovating or repairing 100 homes.

The agency works with El Centro to pair families with properties.

Homes for Generations, a program within the Wyandotte County Public Health Department, received $50,000 to help preserve inherited wealth by clearing titles.

Bienvenido a Mi Casa participants meet monthly.

Eventually, El Centro would like to expand the program to Johnson County. The agency has an office in Olathe.

An early requirement of the program is opening a bank account, usually with First Federal Bank of Kansas City. Participating families deposit $500 per month.

The deposits go toward a future down payment, with a $5,000 match from the program, when the family is ready to buy a home.

“It’s not for free,” Reynoso said. “It’s a commitment that they make.”

Thirty-five families initially signed up.

Concerns about President Donald Trump’s immigration policies dropped the active participants to 25.

But about a half dozen families are ready and signing mortgages for their first homes.

“We are investing in having financially stable families in our county because we know people with a stable home have more opportunities to have a healthy lifestyle,” Reynoso said.

Latino homeownership strengthens the economy

Ensuring that more Latinos benefit from the wealth-building that comes from homeownership is a strategy for nurturing a more prosperous nation.

“Owning a home is this really big milestone for Latino families,” said Laura Arce, senior vice president for economic initiatives with UnidosUS. “It’s literally how immigrant families feel like they’ve achieved — that they’ve been able to pay for a piece of America.”

The Latino homeownership rate in the United States stood at 49% in 2024, compared to an overall homeownership rate of 65.9%.

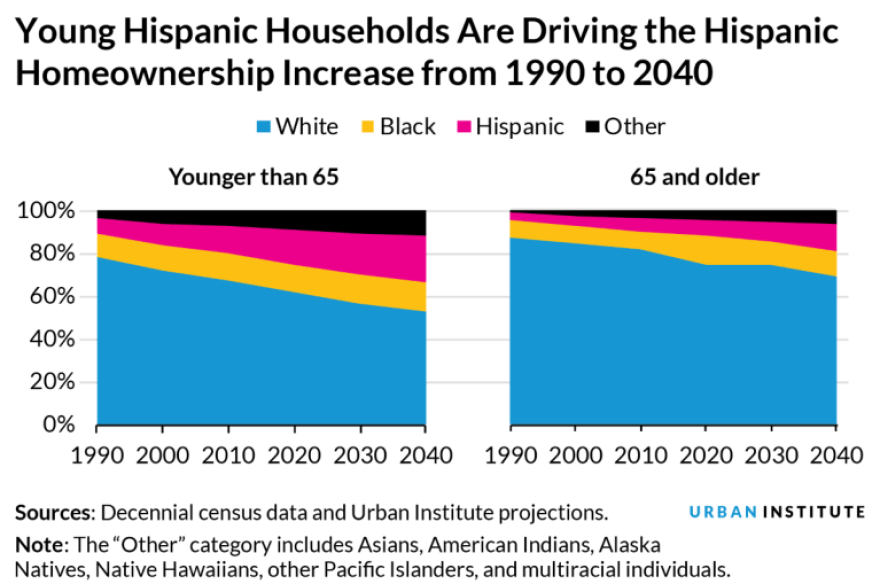

But that gap is expected to close in the future. Latinos are expected to be 70% of net new U.S. homeowners by 2040, according to a 2021 study by the Urban Institute.

The same study predicted that the Latino population will be the only racial or ethnic group that will see an increased homeownership rate by 2040.

Demographics are the reason.

Latinos are the largest ethnic minority, with 65 million people accounting for 20% of the population.

In other words, when Latinos do well, so does the country.

UnidosUS, the nation’s largest Latino civil rights and advocacy organization, is focused on building the prosperity of the nation’s Latino population through homeownership, which stabilizes neighborhoods, increases property values, fuels investment in businesses and generates tax revenue for schools.

The organization’s Home Ownership Means Equity or HOME initiative has a goal of establishing 4 million new Latino homeowners by 2030.

If the goal is met, it will mean the homeownership rate of the nation’s Latinos will rise to about 60%.

Historically, Latinos have been subjected to redlining discrimination in lending.

The Joint Center for Housing Studies of Harvard University issued a report in April 2025 that looked at a wide range of factors, including income, debt, wealth, loans, homeownership, housing structure, mortgage interest rates, language proficiency and health.

Hispanics typically enter homeownership later than non-Hispanic white families, according to the study, “Cumulative Disadvantage in Hispanic Homeownership.”

Significant disparities in savings and nonhousing wealth among aging Hispanics — potentially driven by health-related employment interruptions and rising out-of-pocket health costs — were also found.

“Ultimately, this study reveals how barriers at each stage of the homeownership cycle combine to limit intergenerational wealth transfer in Hispanic communities,” according to the report.

Licensed in Kansas and Missouri. ¡Hablo Español!

At 22, Jonathan Pitallo has been in the real estate business for nearly four years.

He has five other agents working at his Kansas City, Kansas, company, EXP Realty.

All are bilingual in English and Spanish.

“My big mission is just really to empower our people in the community,” Pitallo said.

The Belton High School graduate discovered a passion for the housing market and Kansas City, Kansas, during an internship as a teenager.

He’s a first-generation Mexican American, the oldest of 12 siblings.

“I realized that if I want to change my family’s trajectory, I have to do something,” Pitallo said. “So I said, ‘I’m going to be the one to take the risk and buy some homes.’”

Pitallo owns three properties and a printing business. He joined the Hispanic Chamber of Commerce of Greater Kansas City at 17 and now serves as an ambassador with the organization. He carves out time to speak at area high schools about his life as an entrepreneur.

Like El Centro, Pitallo often works with immigrant buyers who have an individual taxpayer identification number, or ITIN. It’s a tax processing number issued by the Internal Revenue Service for people who might not otherwise qualify for a Social Security number.

Not all banks will process mortgages with an ITIN. Or, a bank might charge higher fees or interest to do so.

Those are some of the reasons that El Centro primarily works with First Federal Bank of Kansas City.

EXP Realty also holds educational workshops, similar to the educational program of El Centro’s Bienvenido a Mi Casa.

Pitallo is sensitive to the concerns that he sometimes encounters from potential clients.

He encourages them, letting people know “there is a route and opportunity for you. It’s a matter of just getting you started and taking those steps to obtain homeownership.”

He explains inflation, encouraging them to invest wisely instead of simply hiding cash.

Other strategies include setting up a power of attorney to protect against a family member being removed from the country through immigration proceedings.

“Ideally, you don’t want someone to assume a mortgage,” Pitallo said. “You just continue to make the payments.”

But both Pitallo and El Centro advocate planning ahead and building financial literacy to help preserve equity for intergenerational wealth accumulation.

“It’s bigger than just buying your first home and having a home for your family,” Pitallo said. “But really leveraging and building wealth through real estate.”

A lack of affordable homes

Homeownership is a primary gateway into the middle class.

“But it’s not as open to them as it has been to past generations,” Arce said of Latinos. “It’s the twin issues of affordability and housing supply.”

El Centro is one of nearly 300 affiliates of UnidosUS.

Guadalupe Centers is also an affiliate.

Guadalupe Centers recently celebrated the opening of Villa View Apartments in northeast Kansas City. The mixed-income project is being marketed toward teachers and families.

Affordable rents are considered a pathway to eventually purchasing a home, because people have more opportunity to save for a down payment.

A tough housing market is complicating the financial and housing needs of Leah and Lane Hensley.

They bought their first home in 2020, a small two-bedroom in Kansas City, Kansas.

“We were so happy,” said Leah Hensley. “Both of us couldn’t believe that we were finally able to do it.”

As foster parents, the young couple wanted to have adequate space for children. And they’ve since adopted two children, now aged 4 and 5. The children attend classes in the Turner School District.

“We were really lucky to find the house that we did, because it was, it’s really, really affordable,” she said.

The two-bedroom house was less than $100,000.

Leah is of Mexican descent. Her credit rating was used for the purchase because at the time her husband was still finishing a degree at Park University.

Both are social workers, with master’s degrees.

As the children grow, the family would like to move to a larger house, using the equity that they’ve accumulated.

They want to remain in Wyandotte County. But they fear their mortgage might double to shift into a three-bedroom home.

“Our kids need their own rooms,” she said. “But the market is scary to think about.”

Ideally, the nation will develop a better feeder system of affordable homes for first-time buyers, and more options as those families want to tap equity and buy another home.

Programs supported by UnidosUS focus on helping people gain access to credit, to increase the supply of affordable housing, and to ensure that people retain ownership of a property.

Modernizing the underwriting process is one approach.

The three Cs used to be weighed for loan approvals — character, capacity and capital.

Now, there are efforts to include rent history.

“It’s kind of intuitive,” Arce said. “If someone’s been making the rent payment on time for some number of years, that seems to be a pretty positive indicator for how they will behave when they have a mortgage.”

Even with a strong credit score, a lack of affordable housing is a consistent barrier.

“The starter home is like an endangered species in so many markets,” Arce said.

As a result, it is increasingly difficult for anyone who isn’t a homeowner to become one. It’s a problem for many people, but disproportionately affects Latino and Black families.

“That’s generally what we’re seeing,” Arce said. “And it’s certainly playing out in places like Kansas City.”

This story was originally published by The Beacon, a fellow member of the KC Media Collective.